Bitcoin’s rise has reshaped how we think about value—especially when it comes to real-world assets like land.

What once required whole coins now takes only a fraction, revealing just how much purchasing power Bitcoin has gained over time. One of the clearest ways to visualize this shift is by comparing Bitcoin to something tangible and timeless: an acre of land in Texas.

Over the years, as Bitcoin adoption has grown and traditional currencies have struggled with inflation, the gap between fiat and crypto purchasing power has widened. Looking at how many bitcoins it takes to buy a single acre offers a compelling lens on Bitcoin’s evolution—and its potential future.

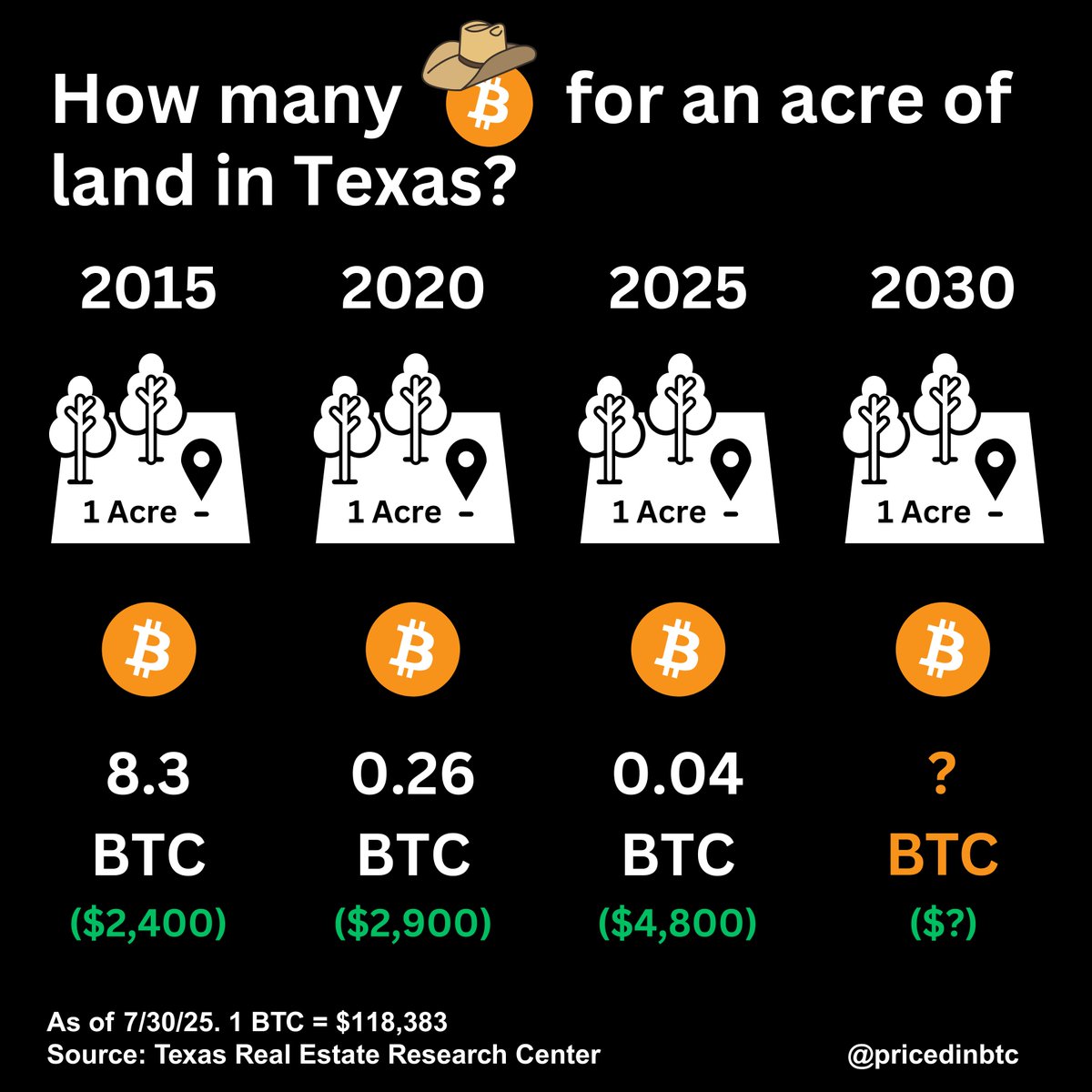

In 2015, buying an acre of land in Texas would’ve cost you 8.3 BTC—valued around $2,400 back then. Fast-forward to 2025, and that same acre now costs just 0.04 BTC, or about $4,800 at today’s exchange rate of $118,383 per Bitcoin.

That’s a staggering 99% drop in BTC terms over the past decade, even though the land price in U.S. dollars has doubled. As PricedinBTC highlights, land priced in fiat increased +100%, while land priced in Bitcoin fell -99%—a powerful illustration of how Bitcoin has preserved and multiplied long-term purchasing power.

By 2020, the cost had already dropped to 0.26 BTC. And now, with land still rising in fiat and Bitcoin continuing to appreciate, many are asking: How little Bitcoin will you need by 2030 to buy a full acre—0.01 BTC? Less?

This trend underscores Bitcoin’s potential not just as an investment, but as a unit of account for real-world assets. In fewer than 10 years, it flipped the affordability dynamic completely—what once took whole coins now takes fractions.

The takeaway is clear: the earlier you accumulated Bitcoin, the more powerful your purchasing leverage became. And if this pattern continues, a single BTC could one day buy not just an acre—but an entire Texas ranch.

The real question isn’t just how much Bitcoin land costs now—but how much less it might cost you in the future.

Kosta has been working in the crypto industry for over 4 years. He strives to present different perspectives on a given topic and enjoys the sector for its transparency and dynamism. In his work, he focuses on balanced coverage of events and developments in the crypto space, providing information to his readers from a neutral perspective.

SHARES

6 months ago

6 months ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·